Where did SCAMPER come from?

The “s.c.a.m.p.e.r” technique is one of many used in UX consulting. A twin of the brainstorming formula used to create new ideas, SCAMPER redefines or reinvents an existing approach. Many of the questions used in the technique were proposed by Alex Osborn in 1953, while education administrator Bob Eberle organized these questions into the SCAMPER mnemonic in his 1971 book, “SCAMPER: Games for Imagination Development.”

This article aims to consider how UX designers for direct insurance sellers can use the SCAMPER technique when analyzing their customer hand-holding approach. The intended result? Actionable concepts for improving both the experience and the product. We can

- simplify or expand an offer according to what and where we want to sell it;

- build the client-handling process so that the client’s purchase decisions are as smooth and easy as possible;

- identify the right time to introduce new processes;

- determine which processes can or should be replaced with others;

- figure out how economically effective it would be to introduce new solutions;

- actively involve the customer in building the final product; and

- comprehensively explore the actions users/customers take.

Selling “peace of mind” the modern way

Direct insurance sales are experiencing a second flourishing. Based on market analysis (by EY, Deloitte and Accenture), the industry’s average annual growth is estimated at 10% year over year for 2022-2023. This growth is at least partly due to mechanisms such as:

- the availability of comparison websites, leading to online purchase mechanisms powered by APIs;

- the pandemic-related geopolitical situation;

- the influence of consumer habits, particularly among those aged 18-30; and

- the increasing importance of mobile channels and the ability of insurance wizards to personalize offers.

The most significant increase was observed in the segments of auto insurance, life insurance and real estate insurance. At the same time, a contraction, not surprisingly, occurred in the travel insurance segment.

In addition to easy access to the comparisons of offers, their configuration, and making choices, direct insurance sales include unobtrusive elements of client hand-holding. Allowing prospective customers to define their needs has increasingly affected business decisions about how to deliver insurance products. Market research, Proof of Concept, and Minimum Viable Product have been added to the decision-makers’ dictionary and are now basic tools for validating concepts. Initiatives can be launched at the early stages and integrated into the product’s final form.

One of the techniques you might use to find creative ideas for new insurance products is the SCAMPER method.

The SCAMPER method

Any time you get a team together for a creative thinking meeting analyze an existing product or service, you can follow these steps:

- Substitute: What parts of your product can be swapped for something different? This could be a different digital format, a different material, a different phrase (microcopy), a different language or tone, and so on.

- Combine: Can one part or process be used to reach more than one result? (Be careful with this one, since this could result in bloat and nonintuitive UI.)

- Adapt: What can be changed to update your product to meet—or create!—new market realities?

- Modify: Whereas ‘substitute’ is about replacing one component with another, here we’ll just change something about what’s already there. We could change a shape, a color, the arrangement of buttons, and so on.

- Put to another use: Much like the lateral thinking technique, which asks a workshop group to come up with alternative uses for a brick or a paper clip, here we ask the participants to put the product or some aspect of the product to another use.

- Eliminate and minimize: Apple is famous for this part of the technique, being the first to try to reduce the number of different ports on its computers and, later, its phones. Consider the Pareto Principle: what component or function of your product is used by less than 20% of your users?

- Reverse or rearrange: Can you flip the order of a process or the arrangement of features on a product? One way to help thinking creatively about this is to imagine trying to complete a task in reverse or to do the exact opposite of the task.

Applying the SCAMPER technique to D2C insurance sales

When considering your website or web app design, simply saying that the customer should experience an easy, comfortable and friendly product-personalization process is far too general. You will need to define some SCAMPER technique aims—that is, to determine if you will focus on the forest, the trees, or the leaves. In terms of your web app, that could mean that you’ll focus on the versions of the products you’re offering, whether your site offers the right mix of tools to determine the right product and whether each question and minor step in the process leads to an optimum end result.

Ideally, you’ll be able to gather focus groups of actual users—some clients, others not, some of each generation, from Z to Boomer. Failing that, we need very good analytical data to carefully build a psychological profile (persona) while taking into account the clients’ real needs and demonstrating how the product we offer meets those needs. That way, we’ll be generating ideas that indicate weak direct sales points, including

- The shopping path is too linear or too generalized, so the client ends up paying for unneeded features

- A lack of support for unique scenarios to meet specific needs

- The user feels a lack of support, either they mistrust the chatbot, or there isn’t a friendly enough or useful microcopy, or the user can’t find branches in the process toward the desired product or features

- Your company’s tech department or contractor didn’t install systems that could quickly and reliably handle these processes, and the user would have to start over due to an error.

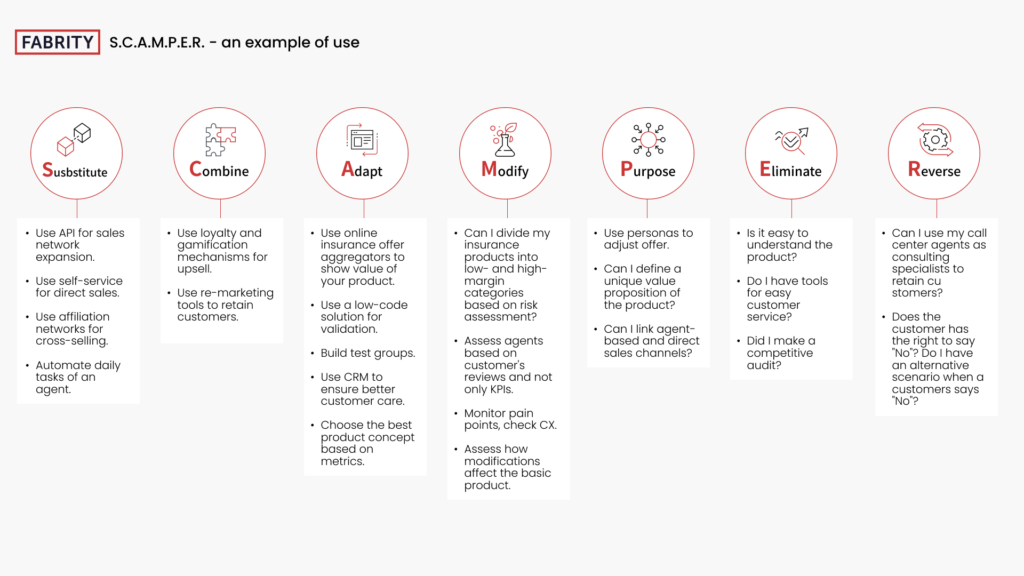

Here is an example SCAMPER analysis, created by a UX designer familiar with the industry, of the way a client is led through the existing process, the client-support ecosystem:

Fig 1. S.C.A.M.P.E.R.—an example of use

Let’s consider a few more innovative ideas:

Adapt technique: Add a gamification activity to attract customers aged 18-25, offering discounts on auto insurance in exchange for promotion through their network.

Substitute technique: Will it work to put a ZIP+4 box in place of the various address fields so that the user doesn’t have to fill out so many fields at the beginning of the process?

Reverse or rearrange technique: What would happen if you listed product features on the first page, and clicking on one led to relevant questions to decide if that or a different feature would benefit the user?

The next step

Obviously, there are barriers to some of these concepts. For example, the gamification idea might face legal hurdles. Keep in mind that the technique is simply a brainstorm, making it easy to note issues that need addressing. Evaluating these ideas comes next, to accurately determine which direction to continue in as you investigate the product or service and its delivery method. What’s necessary for your client hand-holding process?

- How possible is it to use e-commerce mechanisms to accurately model paths that support the customer’s purchasing process, while also taking into account what happens after the customer completes a purchase?

- How well do your inbuilt scenarios match each stage of the client hand-holding process, and how predictable is each step so that each moment of client interaction is appropriately supported?

- To what extent can the customer be said to co-create the product? How well do we actually meet the customer’s needs?

- Are we able to use the data collected in the process to build a startup group for a new or modified product based on innovative ideas?

Wrap up

Clearly, customers are increasingly turning to the internet to find insurance solutions, whether that means directly to a provider’s webpage or to an aggregator channel. Aggregators, however, are going to struggle to customize policies from the providers they work with—so there’s an opportunity for the provider to advertise how easy it is for customers to find your product, smoothly personalized for their needs without having to pay for unnecessary coverage. The SCAMPER technique can help you find innovative ideas to improve your process.