A complete understanding of the customer’s decision-making process is key to improving sales for insurance companies. User experience plays an indispensable role in getting to know the user flow. UX design techniques such as mind mapping can help an insurance agent to become not only a great seller but also a professional advisor, efficiently identifying the behavior and needs of the client.

This article focusses on insurance companies that sell their products through a network of agents (or multi-agency networks). In such an approach, agents act as representatives selling the products (car insurance, life insurance, digital products, etc.) of the insurance company they work with.

Before we move on to the practical applications of UX in insurance solutions, however, let’s stop for a moment to gather a better understanding of the insurance market and present the main barriers that prevent agents from selling insurance products.

Our insights from a survey among insurance agents

We recently carried out a couple of interviews with insurance agents. The insights and details we obtained are as follows:

- Agents need more information about their clients as well as dedicated mechanisms to maintain relationships and build interest in other products.

- Sometimes, the agents themselves take the initiative, playing the role of a concierge.

- Many multi-agents use contacts in customer service to limit the re-marketing functions. They effectively block the customer’s desire to search for products through other channels.

- The agent’s main goal is to present a proposal for comparison as quickly as possible. The price criterion is started and then negated.

- Commissions are secondary to agents. They look for touchpoints for micro-risk products that are the most lucrative. If they have limits to fulfill their monthly plan, there is a risk of creating pathological sales targets.

Other concerns of insurance agents

Agents are sometimes ineffective in selling products, as they don’t know what the customer purchase path looks like. Some of them also have too little knowledge about their clients. Solutions such as mind mapping show what the actual decision-making process of an insurance policy looks like and how complicated it can be. UX design tools can solve these issues.

The biggest concerns among agents working for insurers in the network of agents (or multi-agency networks) model include:

No access to structured data

Very often, only a specific agent knows the customers’ needs. This information is not shared and stored within the organization. An agent, for example, knows that customers will either build a factory or will soon have a fleet of 20 new cars. If they do not receive an attractive offer on time, they will leave for the competition. Discontinuity in communicating customer information undermines their loyalty to the insurance company and affects transparency.

Challenging onboarding of new agents

Sometimes, the customer service model does not allow for a quick and precise comparison of insurance products. When collaboration relies heavily on an agent’s knowledge, onboarding new agents becomes more difficult. Such a strategy harms task flows and the pace of development of the potential customer network. New agents have to learn many systems from the beginning before they can start to deliver. And it takes time.

Too little time

Clients compare insurers’ offers using other systems. They prefer self-service, visiting insurance websites on their own. This may result in the loss of the customer, especially when the comparison site offers the possibility of immediate completion of the transaction. A single agent cannot check multiple offers from other insurance agencies. To compare offers from different insurers and gain clients, they sometimes sign contracts for family members to have comparative material.

No product distinguishing feature

Products like life or car insurance are often compared in terms of features, but the most important aspect is the price and time to finalize the contract. This approach can be very deceptive if we look at the problem from the customer’s perspective and the product configuration options. The insurance product can contain other elements (e.g., additional windshield insurance as a part of car insurance) that can play an important role in the customer’s purchase decision.

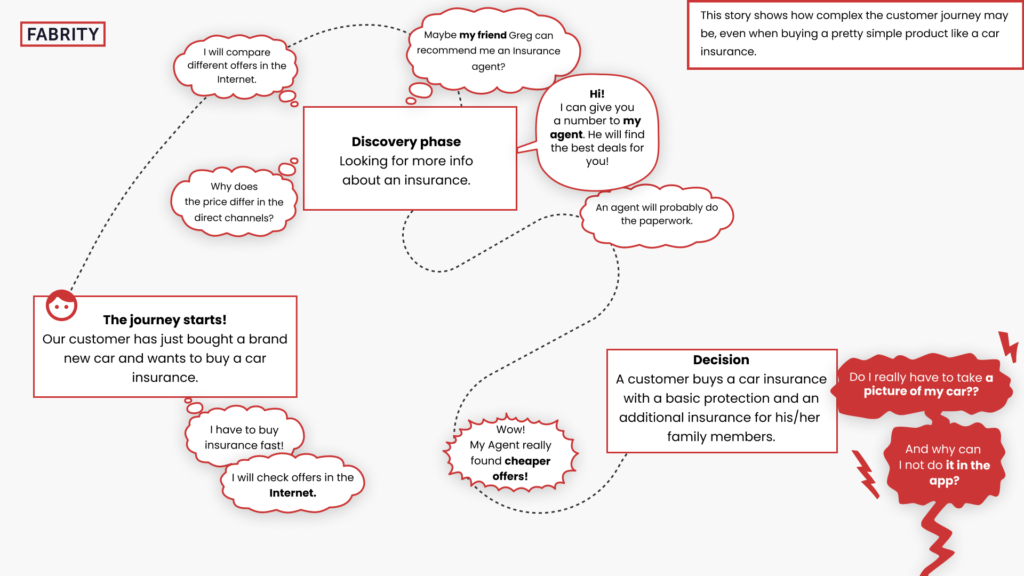

In fact, a simple purchase process for insurance can become a very complex mind map when you add up all factors that play a role in it. When we add in a short time to make a decision, the role of insurance agents becomes slightly puzzling. Are they only sellers, or are they supposed to have an advisory function as well?

Fig. 1. A mind map of an insurance purchase process

An ideal sales process

In an ideal scenario, agents have much more at their disposal than just a fair price and a shorter time to contract finalization. First of all, they need quality which may mean a bunch of selected additional options, for instance when selling car insurance:

- a replacement car

- accommodation in a hotel after the theft/breakdown of the vehicle

- a wide range of assistance

And much more.

It is equally significant to highlight what the client should not spend money on because the risk of a given event is low. A good consultant will replace unnecessary services with those appropriate for a given client. The idea of UX in insurance is to transfer knowledge on this subject from a single, well-prepared agent to the level of a company’s procedures.

Such an approach ensures that the sales process is the same for the entire organization, not just the most effective agents.

How can it make an agent’s life easier?

User experience design is becoming an active tool in consulting business processes. Workshops, mapping, research, tests, and active cooperation with technology and business analysts, make UX very much a tool for filling the consulting space. Why do we mention it? Because a methodical approach to the challenges of the insurance industry allows for more effective identification of clients’ needs and reaching them with optimal solutions.

With good UX tools, it’s possible to systematize information from customers, agents, customer support teams, business decision-makers, and IT teams.

Let’s look at an example solution. The use of the mind map technique alone allows you to create a picture of a situation that will be very helpful in constructing customer journeys and predicting customer purchasing decisions and user engagement.

UX analysts collect such data in search of patterns. Sometimes, they average the results to the defined target group, i.e., the selected persons. In other cases, they build direct scenarios, defining customer journeys more precisely. Thanks to this, it is possible to map, i.e., verify, where we are dealing with:

- Likelihood of a purchase. We learn when and how to help the client make a decision.

- Risk of losing a customer. In such a situation, it is worth contacting them through other channels.

- Assess the weaknesses of the system. Thanks to this, you can find out how to facilitate the user experience for your clients and help them make a purchase decision.

A correctly implemented purchasing path based on a mind map enables the reduction of pathological situations, and the process of cooperation between the agent and the client reduces to the facilitation of the purchase process, not the actual sale, where the benefits of the customers and the insurers brand may be relegated to the background.

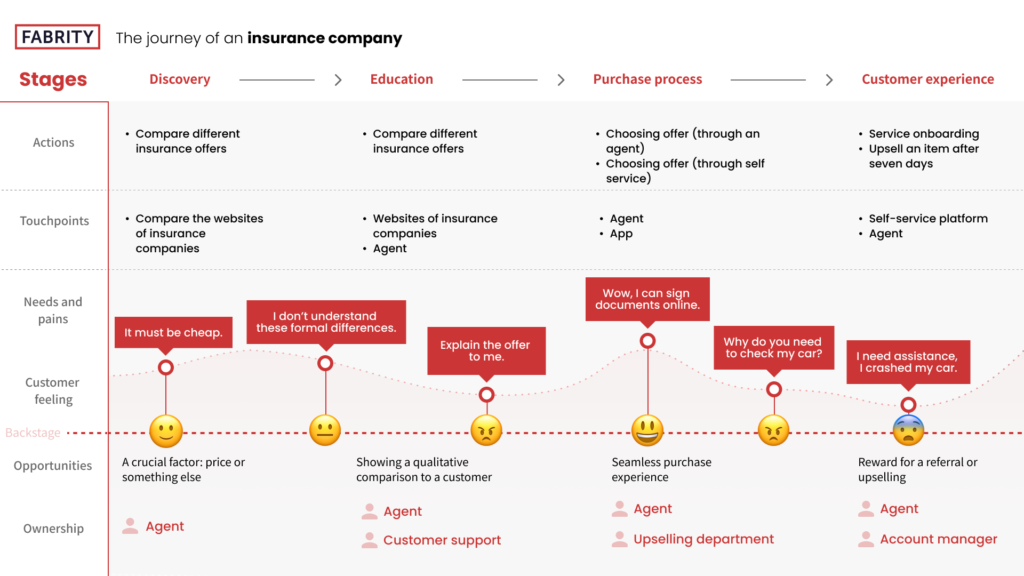

Fig. 2 An example of a purchasing path in the insurance industry

UX tools in consulting business solutions

Consulting offers many tools leading to the achievement of the set business goal. The first step is usually to talk to your team and try to identify the underlying problems with tools such as:

- Mind maps. Helping to identify the mindset of customers. It also helps to understand how they complete the purchase. Developing a mind map is a bit like the process of designing a game, where you define mental and behavioral steps and finally either address them or establish paths for returning to the linear scenario.

- Methods such as SCAMPER, Touchpoints Map, Concept Map, Customer Journey Map, or Empathy Map. They are so-called ideational tools. Depending on the scale of the problem, they allow for a smooth transition from generalities to details. For example, by addressing a very specific fragment of a scenario, they enable you to put yourself in the role of a client and reconcile various business goals.

- Various types of workshops, research tools such as design sprint, or strategic tools such as Roadmap, prioritization methods, or 4P.

Note, however, that not all techniques are necessary. The type of tools selected depends on the goals that we want to achieve together. The most significant elements in the determination of tools and techniques include:

- Defining the main goal

- The level of the end customer and business involvement

- The level of input data and the possibility to test and verify theses with users

- Budget, together with technological and legal constraints that determine the size of the project and the level of changes.

A gentle method is to carry out small evolutions, systematize the processes, improve them, and reflect them in micro-changes. A bolder approach may mean a revolution for which users need to be well prepared so that they do not react by leaving as a result of the shock of the introduced changes.

UX in insurance—key insights

Agents working in the insurance industry face a lot of limitations in their work. UX design techniques can make their everyday tasks easier and thus increase sales.

The idea is to enable agents to analyze the customers’ behavior while choosing the best offer for their needs (customer journey mapping).

Why is it so important? Because the modern world requires a different role from the insurance agent. The customer can check and click through each offer on the Internet. An agent is no longer just a seller but now an advisor as well.

Appropriate mapping of the client’s decision-making process may mean that insurance companies operating the business model discussed in this article will be able to increase income.

Brilliant agents can achieve high results in relational sales. However, it does require knowledge about the client. Its acquisition is not an easy task.

UX may streamline the work of insurance agents, ensuring that sales do not depend so much on customer relationships, but rather on tools and processes that are always improving and available throughout the organization.